A combined photo of NEM Insurance and its chairman, Tope Smart

By Victory Oghene

NEM Insurance Plc is in the news for the wrong reason as a Nigerian has criticised the insurance company for failing to live up to its responsibilities.

NATIONAL WAVES gathered that the Nigerian is currently facing financial and emotional stress after NEM Insurance Plc allegedly failed to honor a valid travel insurance claim, sparking outrage on social media and raising questions about accountability in Nigeria’s insurance sector.

NEM Insurance’s client is a mother who traveled to the United Kingdom in September under a travel insurance policy purchased from NEM is unhappy at the moment.

Shortly after arriving, she fell ill and received treatment at the NHS, resulting in a bill of £2,551. Despite the policy covering such medical emergencies, the insurer has reportedly refused to settle the claim, leaving the family to deal directly with repeated NHS requests for payment.

The family reportedly reached out multiple times to senior NEM officials, including Wunmi Olatunbosun, Daniel Okuchemiya, Julius Elusakin, Wasiu Osunbiyi, and even the company’s chairman, Tope Smart, but received no response. The lack of communication has forced them to take their complaints public, highlighting frustrations many Nigerians have with insurers who fail to honor legitimate claims.

Industry experts say incidents like this erode trust in Nigeria’s insurance sector and underscore the need for stricter enforcement, transparency, and consumer protection mechanisms. Observers argue that professional insurers should communicate promptly with both clients and service providers to prevent unnecessary financial hardship and reputational damage.

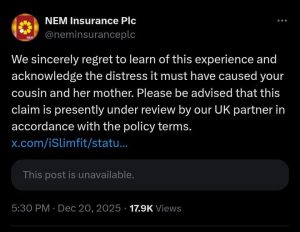

Efforts by NATIONAL WAVES to make NEM Insurance react to the allegations were unsuccessful as it was yet to react to our enquiries as at press time but NATIONAL WAVES got the insurance company’s response via its X handle. While reacting to the development, NEC Insurance via its X handle stated “Following our recent discussion with your cousin’s representative in Nigeria, we are diligently pursuing efforts to facilitate the prompt settlement of the NHS bill. However, to provide additional reassurance, if the payment remains outstanding with Mapfre—which we highly doubt,

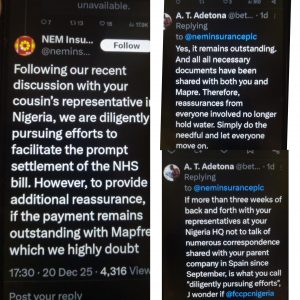

In response, a cousin to the customer, AT Adetona replied “If more than three weeks of back and forth with your representatives at your Nigeria HQ not to talk of numerous correspondence shared with your parent company in Spain since September, is what you call “diligently pursuing efforts”, I wonder if @fccpcnigeria would agree with you

“Yes, it remains outstanding. And all all necessary documents have been shared with both you and Mapre. Therefore, reassurances from everyone involved no longer hold water. Simply do the needful and let everyone move on.”