A combined picture of Union Bank MD, Yetunde Oni and Union Bank logo

By Victory Oghene

Some account holders with Union Bank of Nigeria Plc are currently jittery and may consider closing their accounts due to the N9.3 billion fraud that rocked the bank.

NATIONAL WAVES gathered that hacker gained access into the bank’s system stealing N9.3 billion in the process.

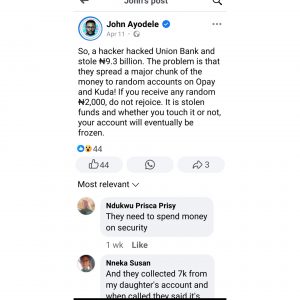

A Facebook user, John Ayodele first broke the news of how hackers stole a staggering N9.3 billion from the bank on social media. He wrote “So, a hacker hacked Union Bank and stole ₦9.3 billion. The problem is that they spread a major chunk of the money to random accounts on Opay and Kuda! If you receive any random ₦2,000, do not rejoice. It is stolen funds and whether you touch it or not, your account will eventually be frozen”

Screenshot of John Ayodele’s post on Facebook

Ayodele’s post received lots of reactions from netizens as many expressed shock and disbelief over the development.

The leadership of the bank led by the Managing Director, Yetunde Oni, is stiff worried by the catastrophic operational system breach.

The financial heist—uncovered on March 23, 2025—saw unauthorized transfers from customers’ accounts amounting to N9,329,322,870.00. The funds were systematically moved across multiple accounts in 53 different financial institutions, raising fresh alarms over the resilience of the country’s banking systems.

This comes just a year and three months after the Central Bank of Nigeria (CBN) took drastic action by dissolving Union Bank’s board and executive leadership due to governance failures. A new management team was appointed to steer the bank into a more secure and compliant future. But now, that future appears precariously uncertain.

Union Bank, in a suit marked FHC/L/CS/629/2025 before the Federal High Court in Lagos, is seeking a preservative order to freeze the accounts of all suspected recipients. The bank hopes to recover the massive sum siphoned from unsuspecting customers.

In an affidavit filed by Oluwasegun Falola, the head of Union Bank’s E-Fraud Investigations Department, the bank traced the illegal transfers to a breach in its core banking infrastructure. Falola revealed that the bank’s fraud desk uncovered that the funds were discreetly funneled into various accounts and rapidly re-routed to other beneficiaries.

“The fraud occurred as a result of an operational system glitch and deliberate exploitation,” Falola explained, highlighting how quickly the perpetrators dispersed the funds in an attempt to cover their tracks.

When the case was presented in court on April 2, 2025, Union Bank’s counsel, A. Adedoyin-Adeniyi, confirmed that the funds were still being moved—implying an ongoing laundering effort.

N9.3 billion has been moved from the account, and they are still moving funds. We now have more people involved in moving the funds,” Adedoyin-Adeniyi told the court.

Justice Deinde Dipeolu promptly granted the bank’s motion to freeze the implicated accounts, signaling the judiciary’s urgency in supporting financial institutions under threat.

Efforts to speak to Olufunmi Aluko, Chief Brand and Marketing Officer of Union Bank on the development failed as calls to her mobile phone were not answered neither were the text messages acknowledged.